Best Senior Travel Insurance Options: 3 Solid Advice

Last Updated on August 12, 2025 by Rose Ann

Are you ready to explore the world during your retirement years but concerned about the “what ifs” that could derail your travel dreams? You’re not alone. Around 37% of all travelers were seniors in 2024, making mature travelers a significant force in the tourism industry, yet many still hesitate to book that dream trip without proper protection.

Travel insurance isn’t just another expense—it’s your passport to worry-free adventures. Whether you’re planning a Mediterranean cruise, exploring European capitals, or taking that cross-country RV trip you’ve always dreamed of, the right insurance coverage transforms anxiety into excitement.

This comprehensive guide reveals everything you need to know about securing travel insurance that actually works for your unique needs as a mature traveler. We’ll explore why standard policies often fall short for seniors, uncover the best coverage options for different types of trips, and share insider tips for finding exceptional value without compromising protection.

You’ll discover how to navigate pre-existing condition coverage, understand the crucial differences between cruise line insurance and third-party policies, and learn which companies consistently deliver the best service for mature travelers. We’ll also reveal the essential coverage minimums that could save you thousands in medical expenses abroad.

Don’t let uncertainty keep you from the adventures you’ve earned. With the right knowledge and coverage, you can confidently book that bucket-list trip and focus on creating memories that will last a lifetime.

Why Senior Travel Insurance Deserves Special Attention

Travel during your retirement years offers unparalleled opportunities for exploration and enjoyment, but it also comes with unique considerations that standard travel insurance policies may not adequately address. While a standard travel insurance policy averages 4% to 10% of total trip costs, it can be considerably higher for travelers over 60, making it essential to find the right balance between comprehensive coverage and reasonable costs.

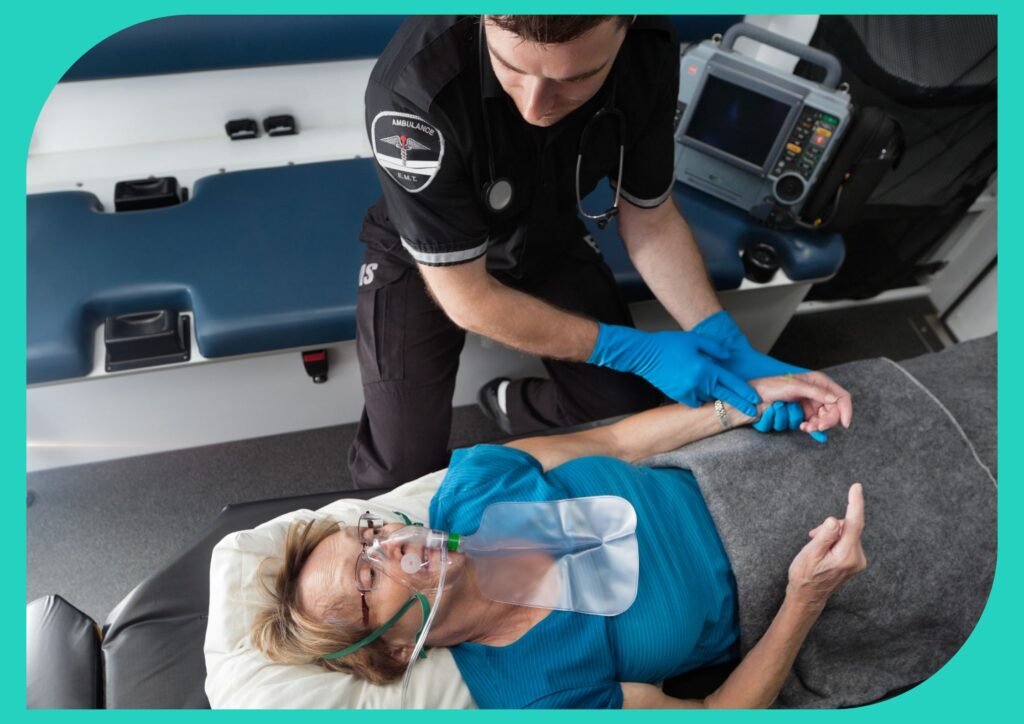

As we journey through life’s golden years, the significance of comprehensive travel protection steadily grows. With each passing year, our bodies accumulate stories, and it becomes paramount to prioritize well-being, especially when embarking on travel adventures.

“Having the right travel insurance gave me the confidence to book my dream Mediterranean cruise,” shares Margaret Wilson, 72, a retired teacher who recently returned from a two-week voyage. “Knowing I was covered for medical emergencies in foreign countries allowed me to truly relax and enjoy every moment.”

For seniors planning trips, particularly cruises or international journeys, standard travel insurance policies often fall short in addressing age-specific concerns. Many traditional policies impose age limits or significantly higher premiums once travelers reach their 60s or 70s.

Prefer to listen rather than read?

Age-Specific Considerations in Travel Insurance

When evaluating travel insurance options as a senior traveler, several factors deserve special attention:

- Pre-existing condition coverage becomes increasingly important as we age. Many seniors have managed health conditions that standard policies might exclude, making specialized coverage essential for peace of mind.

- Higher coverage limits for medical emergencies are often necessary, as treatment costs can be substantial, especially overseas. Emergency medical treatment abroad can cost tens of thousands of dollars, particularly in countries with expensive healthcare systems.

- Emergency evacuation insurance takes on greater significance for seniors, particularly when traveling to remote destinations or participating in cruise vacations that visit multiple international ports. Medical evacuation from a cruise ship can cost over $100,000.

- Trip cancellation and interruption protection offers peace of mind as unforeseen health issues might necessitate last-minute changes to travel plans. This protection becomes more valuable as trip costs increase with age and health considerations.

Types of Travel Insurance for Seniors

Comprehensive Travel Insurance

Comprehensive policies offer the most extensive protection, typically covering:

- Emergency medical treatment (including hospitalization)

- Medical evacuation and repatriation

- Trip cancellation and interruption

- Lost, damaged, or delayed baggage

- Travel delays and missed connections

- 24/7 emergency assistance services

For seniors, comprehensive policies that specifically cater to mature travelers offer the most robust protection. Current top-rated companies for senior coverage include Travel Insured International for medical coverage, Seven Corners for comprehensive benefits, and Travelex for pre-existing conditions.

Cruise-Specific Insurance

For seniors embarking on cruise adventures, specialized cruise insurance provides tailored coverage for the unique aspects of sea travel. These policies typically include:

- Coverage for missed port departures

- Cabin confinement compensation due to illness

- Shipboard medical treatment coverage

- Shore excursion cancellation protection

- Medical evacuation from remote ports or at sea

Cruise lines often offer their own insurance products, but it’s worth comparing these with independent providers who might offer more comprehensive coverage at competitive rates.

Medical-Only Travel Insurance

For seniors with existing trip cancellation protection (through credit cards or other means), medical-only policies provide focused coverage for health concerns while traveling. These plans typically cover:

- Emergency medical treatment

- Hospital stays and doctor visits

- Prescription replacement

- Emergency medical evacuation

- Repatriation of remains

Medical-only plans are often significantly less expensive than comprehensive coverage while still addressing the most critical concern for many senior travelers: health emergencies abroad.

Annual Multi-Trip Insurance

For seniors who enjoy frequent travel, annual multi-trip policies offer convenience and potential cost savings. These plans provide continuous coverage for multiple trips throughout a year, typically with:

- Coverage for any number of trips within a 12-month period

- Trip duration limits (often 30-45 days per trip)

- Consistent medical coverage across all journeys

- Simplified planning with one annual purchase

Companies like Seven Corners, Nationwide, and AIG Travel offer annual plans with senior-friendly options and fewer age restrictions than many competitors.

Pre-Existing Conditions: Navigating the Complexity

One of the most significant concerns for senior travelers is coverage for pre-existing medical conditions. Many standard policies exclude coverage for conditions that existed before the policy’s effective date.

However, specialized senior travel insurance often offers pre-existing condition waivers under certain circumstances:

- Early purchase windows: Many insurers offer pre-existing condition coverage if you purchase the policy within 14-21 days of making your initial trip deposit.

- Stability periods: Some policies cover pre-existing conditions if they’ve been stable (no changes in medication or treatment) for a specified period before the policy’s effective date, typically 90-180 days.

- Medical underwriting: Some specialized senior policies offer coverage based on medical questionnaires rather than blanket exclusions.

Jane Thompson, 68, who manages type 2 diabetes, shares: “I was worried about finding coverage for my European river cruise because of my condition. By purchasing insurance within two weeks of booking my trip and completing a simple medical questionnaire, I secured comprehensive coverage that included my diabetes-related concerns.”

Cost Factors and Finding Value

Premium costs for senior travel insurance can vary significantly based on several factors:

- Age: Premiums typically increase with age, with significant jumps at 65, 70, 75, and 80.

- Trip cost: Higher-priced trips result in higher premiums due to increased cancellation coverage.

- Trip length: Longer journeys require extended coverage periods.

- Destination: Travel to regions with high medical costs (like the U.S.) or remote locations results in higher premiums.

- Coverage limits: Higher medical coverage limits increase premium costs.

Finding Value Without Sacrificing Protection

While cost is certainly a consideration, finding value in senior travel insurance means balancing premium costs with adequate protection. Consider these strategies:

- Compare multiple providers: Premium costs can vary by hundreds of dollars for similar coverage. Among top companies, the average cost for senior plans is around $389, but prices vary significantly by provider.

- Consider a higher deductible: Opting for a higher deductible can lower premium costs while still providing protection against major expenses.

- Evaluate coverage limits carefully: Choose appropriate coverage based on destination. For example, medical coverage of $100,000 might be sufficient for a Caribbean cruise but inadequate for a European tour.

- Look for senior-specific discounts: Some companies offer lower rates for members of organizations like AARP or alumni associations.

- Consider package deals: Some providers offer discounts when purchasing coverage for couples or travel companions.

Special Considerations for Cruise Travel Insurance

Cruises represent a perfect vacation option for many seniors, offering the allure of multiple destinations with the comfort of unpacking just once. However, cruise travel presents unique insurance considerations:

Medical Care at Sea

Ship medical facilities vary widely, from basic clinics to well-equipped medical centers. However, treatment on board can be expensive and is typically charged at private U.S. rates, often exceeding $5,000 per day for serious conditions.

Medical evacuation from a cruise ship, particularly in remote locations, can require coverage of $500,000 or more to address this significant risk. Specialized cruise insurance typically offers higher evacuation coverage limits to address this unique exposure.

Missed Departures and Itinerary Changes

Cruise ships operate on strict schedules and won’t wait for delayed passengers. Quality cruise insurance provides coverage for:

- Transportation costs to the next port if you miss embarkation

- Accommodation expenses while catching up to your ship

- Reimbursement for missed portions of your cruise

Cruise lines also may change itineraries due to weather, mechanical issues, or other factors. Some policies provide compensation for significant port cancellations or changes.

Choosing Between Cruise Line Insurance and Third-Party Coverage

Cruise lines typically offer their own insurance products at the time of booking. While convenient, these policies often:

- Provide lower coverage limits than specialized third-party insurance

- Offer less comprehensive medical evacuation coverage

- Cost more than comparable third-party options

- Limit coverage to the cruise portion of your journey

Robert and Carol Miller, both in their mid-70s, learned this lesson on their Alaska cruise: “We initially considered the cruise line’s insurance but after comparing benefits, we chose a third-party policy that offered twice the medical coverage and included our pre-cruise stay in Seattle—all for about $50 less than the cruise line’s option.”

The Claim Process: What to Know Before You Go

Understanding the claims process before departing can save considerable stress if emergencies arise during travel. Most quality senior travel insurance includes:

24/7 Emergency Assistance

This crucial service provides:

- Help locating appropriate medical facilities

- Coordination with doctors and hospitals

- Communication with family members

- Arrangement of medical evacuations if necessary

- Assistance with the replacement of lost medications or documents

Documentation Requirements

Successful claims require proper documentation. Always:

- Keep detailed records of all medical treatments

- Obtain written statements from the cruise medical staff

- Save all receipts for expenses related to disruptions or medical care

- Take photographs of accidents, injuries, or property damage

- File police reports for theft or loss when applicable

- Contact your insurance provider immediately when incidents occur

Medical Emergencies Abroad

If facing a medical emergency while traveling:

- Contact your insurance provider’s emergency assistance line before seeking treatment when possible

- If immediate care is needed, have someone contact the insurance company while you receive treatment

- Understand that many foreign medical facilities require upfront payment—keep your credit card and insurance details accessible

Comparing Top Providers for Senior Travel Insurance

Several insurance providers stand out for their senior-friendly policies:

Allianz Global Assistance

Travelex Insurance

- Features plans with no age-based pricing increases

- Offers pre-existing condition coverage when purchased within 21 days of initial trip payment

- Provides up to $50,000 in emergency medical coverage

- Offers coverage with no upper age limit on select plans

- Provides up to $50,000 in emergency medical coverage

- Includes pre-existing condition waivers when purchased within 14 days of initial trip deposit

Travel Guard

- Provides policies for travelers of all ages

- Offers up to $100,000 in medical coverage on preferred plans

- Includes coverage for common carrier accidents

Seven Corners

- Specializes in coverage for senior travelers

- Offers plans specifically designed for cruises

- Provides up to $250,000 in medical evacuation coverage

IMG Global

- Features plans specifically for seniors up to age 95

- Offers renewable coverage for longer trips

- Provides customizable coverage limits

Making Your Decision: A Step-by-Step Approach

When selecting the right travel insurance for your needs, follow these steps:

- Purchase early: Buy coverage shortly after making initial trip deposits to qualify for pre-existing condition waivers and maximum benefits.

- Assess your health needs: Consider any existing conditions and potential medical requirements.

- Evaluate your trip specifics: Consider destination, activities, total cost, and cancellation concerns.

- Determine coverage priorities: Decide whether medical coverage, trip cancellation, or other benefits are most important to you.

- Research age-specific restrictions: Eliminate providers with problematic age limitations or excessive age-based premium increases.

- Compare at least three options: Obtain quotes from multiple providers with similar coverage levels.

- Read the fine print: Pay special attention to exclusions, pre-existing condition clauses, and required documentation.

Travel Insurance Checklist: Essential Coverage for Seniors

When evaluating policies, ensure they include these key components:

- Emergency medical coverage ($50,000 minimum for international travel)

- Medical evacuation coverage ($100,000+ for international/cruise travel)

- Pre-existing condition coverage or waiver option

- Trip cancellation and interruption protection

- Coverage for baggage loss or delay

- 24/7 worldwide emergency assistance services

- Coverage for the entire duration of your trip

- Reasonably priced deductibles

- Financial stability rating of “Good” or better for the insurance company

Quick Tips for Senior Travelers

- Carry your insurance information at all times while traveling, including policy numbers and emergency contact information.

- Consider a medical alert bracelet if you have specific health conditions that emergency personnel should know about.

- Pack a sufficient supply of medications in your carry-on luggage, plus a few extra days’ worth in case of travel delays.

- Research medical facilities at your destinations before departing.

- Share your itinerary and insurance information with family members or emergency contacts at home.

Is Travel Insurance Worth It for Seniors?

For most seniors, specialized travel insurance represents an essential investment rather than an optional expense. The senior citizen travel insurance market is expected to reach $16.7 billion by 2032, reflecting the growing recognition of its importance. The potential financial impact of medical emergencies abroad, trip cancellations due to health issues, or the need for emergency medical evacuation far outweighs the premium costs.

Dorothy Henderson, 78, who experienced a fall requiring hospitalization during her European river cruise, shares: “My $600 insurance policy covered over $18,000 in medical expenses and arranged my transportation home when I couldn’t continue the journey. It was the best $600 I’ve ever spent.”

While travel insurance adds to your vacation budget, it provides something priceless: the confidence to explore, experience, and enjoy your travels without the shadow of “what if” hanging over your adventure.

Senior Travel Insurances for a Safe Adventure

Ready to book that dream trip you’ve been planning? The world is waiting for you, and with the right travel insurance in place, you can explore it with complete confidence. Have you already purchased travel insurance for previous trips, or are you researching options for an upcoming adventure? What factors are most important to you when choosing coverage—medical protection, trip cancellation benefits, or something else entirely? Share your travel insurance experiences or questions in the comments below—your insights could help fellow travelers make the best decision for their next journey!

FAQ: Senior Travel Insurance

- How does age affect travel insurance premiums?

- Age is a significant factor in determining travel insurance premiums. Costs typically increase around age 65, with additional increases at 70, 75, 80, and 85. Some insurers stop offering certain coverages after specific age thresholds, while others specialize in senior coverage with more reasonable age-based pricing.

- Can I get travel insurance with pre-existing medical conditions?

- Yes, many insurers offer coverage for pre-existing conditions through waivers if you purchase insurance shortly after making your initial trip deposit (typically within 14-21 days). Some policies also cover conditions that have been stable for a certain period before the policy’s effective date.

- Is Medicare sufficient for travel medical coverage?

- Medicare generally does not cover healthcare costs outside the United States, except in very limited circumstances. Even within the U.S., Medicare doesn’t cover emergency evacuation or repatriation. Supplemental insurance is strongly recommended, especially for international travel.

- What’s the difference between trip cancellation and “cancel for any reason” coverage?

- Standard trip cancellation covers specific situations like illness, injury, or death of you, a traveling companion, or a family member. “Cancel for any reason” (CFAR) coverage, available as an upgrade on many policies, allows you to cancel for literally any reason but typically reimburses only 50-75% of trip costs and must be purchased shortly after your initial trip deposit.

- How much medical evacuation coverage do seniors need?

- For international travel, medical evacuation coverage of at least $100,000 is recommended. For cruises or travel to remote locations, $250,000 or more provides better protection against the potentially enormous costs of medical transport from ships or isolated areas.

- Is the insurance offered by cruise lines adequate for seniors?

- Cruise line insurance is convenient but often provides lower coverage limits and fewer benefits than third-party policies. For seniors with pre-existing conditions or those seeking comprehensive protection, third-party insurance typically offers better value and more appropriate coverage.

- How soon before my trip should I purchase travel insurance?

- For maximum benefits, purchase travel insurance within 14-21 days of making your initial trip deposit. This timing typically qualifies you for pre-existing condition waivers, “cancel for any reason” upgrades, and financial default protection.

Disclaimer:

The content provided on MySeniors.World is for informational purposes only and is not intended as either financial or medical advice. Always consult a qualified professional before making any investment or health-related decisions.

Posts may contain affiliate links, meaning we earn a commission – at no additional cost to you, if you click through and make a purchase. Your support helps us continue providing valuable content.

REFERENCES

- The Senior List. (2025, February 18). Senior Travel and Tourism Statistics in 2025. https://www.theseniorlist.com/travel/statistics/

- CNBC Select. (2025). Best travel insurance for seniors in 2025. https://www.cnbc.com/select/best-travel-insurance-for-seniors/

- U.S. News & World Report. (2025, January 14). The Best Travel Insurance for Seniors in 2025. https://www.usnews.com/insurance/travel/travel-insurance-for-seniors

- Globe Newswire. (2024, October 16). Senior Citizen Travel Insurance Market to Reach $16.7 Billion, Globally, by 2032 at 18.3% CAGR. https://www.globenewswire.com/news-release/2024/10/16/2964304/0/en/Senior-Citizen-Travel-Insurance-Market-to-Reach-16-7-Billion-Globally-by-2032-at-18-3-CAGR-Allied-Market-Research.html

- Squaremouth. (2025). 4 Best Travel Insurance Companies for Seniors in 2025. https://www.squaremouth.com/resources/best-travel-insurance/seniors

- NerdWallet. (2025, February 8). Best Travel Insurance for Seniors. https://www.nerdwallet.com/article/travel/best-travel-insurance-for-seniors

- Senior Living. (2025, February 4). Best Travel Insurance for Seniors in 2025. https://www.seniorliving.org/insurance/travel/best/