Lately, there’s been a worrying increase in scams targeting seniors, mainly because they might not be as savvy with all the new tech and tricks out there. As more seniors come into the picture and tech keeps evolving, this issue is expected to get even bigger. Before delving into scams that specifically target seniors, let’s assess your current understanding of these fraudulent schemes.

Fraudsters are now employing cutting-edge tactics, such as artificial intelligence (AI) voice cloning, to mimic familiar voices and exploit vulnerabilities like isolation and loneliness. This environment of ever-changing technology combined with targeted social manipulation creates a complex threat landscape for older adults.

Top 8 Emerging Scams Targeting Seniors: How to Spot and Avoid Them

Seniors are vulnerable to scammers due to financial security and isolation. Scammers target them knowing they have savings from retirement and steady income. Many seniors experience loneliness, mobility issues, or lack of nearby family, making them vulnerable to narratives that exploit their need for connection and trust. Digital divide adds to this vulnerability, as not all seniors are comfortable navigating the online world, making them susceptible to online scams.

Seniors’ trust in authorities like the IRS or healthcare providers is exploited by scammers impersonating them, leading to sensitive information being shared. Technology advancements, like AI voice cloning, allow scammers to mimic loved ones’ voices, making deception harder to detect. This technological sophistication can deceive even cautious seniors.

Prefer to listen rather than read?

To help raise awareness of these scams targeting seniors, this blog post will provide an overview of the top 8 scams targeting seniors and offer advice on how to identify and avoid them. It’s super important for seniors to know about these tricks so they can keep themselves safe and out of the scammers’ clutches. With the right info, they can dodge these tricky schemes.

Fake Charities

Fake charity scams targeting seniors have become increasingly common, as scammers take advantage of senior’s kindness and generosity. These scams targeting seniors usually begin with a fraudulent charity requesting donations, under the guise of helping sick or elderly people or supporting a noble cause.

Fraudulent Charity Requesting Donations

Typically, the scammers will send a letter, email, or even make a phone call, asking for a donation. They may also send a fake invoice in the mail, that looks like a charity bill, in an attempt to collect money. The scammers will usually use persuasive language to convince the victim to donate money and may even offer incentives such as prizes, and gifts, or claim that the donations are tax-deductible.

Scammer’s Tactics

The scammers will use high-pressure tactics to get seniors to donate money, claiming that these donations are tax-deductible. Unfortunately, when seniors make donations to scammers, the money never reaches those in need and goes straight into the scammers’ pockets.

Not only did seniors not get any tax benefits, but they also didn’t help those in need. In order to ensure that their donation goes towards a purposeful cause and to receive tax benefits, seniors should only donate to well-established and trusted charities that have a long history of helping people.

What to Do to Avoid Fake Charity Scams Targeting Seniors?

Charities often have a website or can be found on the IRS website, so seniors should take the time to research the charity before donating. It is important to read up on the charity’s mission, history, and any reviews from other donors. Seniors should also make sure to ask the charity questions such as how the donations will be used and how the charity is governed and managed.

Seniors should also make sure to get a donation receipt to keep track of their donations in case of an audit. This document should include the charity’s name, date of donation, amount of donation, and a description of the donation. It is a good idea for seniors to keep these documents for tax purposes.

Phishing Scams

These scams targeting seniors are the type of cybercrime where criminals use emails and fraudulent websites to try and obtain sensitive information such as usernames, passwords, and credit card details by pretending to be a legitimate company or organization.

The scammers will often use social engineering techniques to try and trick the victim into providing this information.

Click Bait

Cybercriminals may employ various tactics to trick individuals into providing their login details, such as using a deceptive email from a bank or financial institution. They might also design a counterfeit website resembling a legitimate one to deceive users into disclosing their information. With this data, these criminals can gain unauthorized access to the victims’ accounts, resulting in theft of funds or identity fraud.

Seniors are particularly vulnerable to phishing scams targeting seniors due to a lack of knowledge about the latest technology trends. With many seniors being less accustomed to the digital age, they can be more trusting of messages sent to them via email or text. As a result, they can be easily tricked into providing personal information such as passwords, credit card numbers, and other sensitive data.

What to Do to Avoid Phishing Scams?

They need to be aware of the potential dangers of phishing scams targeting seniors and take steps to protect themselves from becoming victims. Seniors should avoid clicking on unknown links or downloading attachments from unrecognized senders, as this could lead to the installation of malicious software on their devices.

Additionally, they should always be wary of unexpected emails from seemingly legitimate sources, as these could be fraudulent attempts to harvest personal data. If seniors receive an email that looks suspicious, they should double-check the sender’s address and any links included before taking any action.

Investment Fraud

Investment fraud is one of the most common scams targeting seniors in 2024. Fraudsters will use a variety of tactics to try to con seniors out of their money, such as offering investments with guaranteed high returns, unsolicited investment advice, requests for upfront payments, and playing on seniors’ emotions by invoking fear.

Be Careful of Unrealistic ROI

In some cases, seniors are promised unrealistic returns on investments or told that their money is safe and secure when, in reality the investment is risky or fraudulent. In many cases, fraudsters will use false or misleading information to convince seniors to invest in their scheme.

These Type of Scams Are “Too Good to Be True”

It’s important to be aware of the warning signs of investment fraud, such as unsolicited offers, promises of quick and easy profits, and high-pressure sales tactics. Seniors should always be wary of any offer that seems “too good to be true” and take steps to verify the legitimacy of any investment before they commit to it.

In addition to using high-pressure sales tactics, scammers may also try to use false urgency to pressure seniors into making investment decisions quickly. In some cases, they may even offer investments that are not registered with the Securities and Exchange Commission (SEC). Without registration, investors have no assurance that the investment is legitimate and could be putting their hard-earned money at risk.

It is important to be wary of any investment that is not registered with the SEC, as it could be a sign of fraud. Furthermore, if someone is pressuring you to make a decision quickly, it is important to take a step back and thoroughly research the opportunity before investing to make sure it is legitimate.

Medicare Fraud

Medicare fraud is one of the most common scams targeting seniors and is estimated to have cost the US government billions of dollars in false claims. This type of fraud typically involves someone claiming to be a Medicare representative and asking for personal information, or offering a free medical device or service in exchange for Medicare information.

Unfortunately, the elderly are especially vulnerable to this type of fraud, as they may not be aware that they are not supposed to provide Medicare information to anyone outside of their doctor’s office. Common scams targeting seniors include false claims for equipment, services, or supplies that were never received.

There are also billing for services that were never rendered, and providing unnecessary services or equipment in order to receive inflated payments.

Fake Products or Services

The scammer may also ask for money in exchange for a fake product or service, or they may just use the stolen information to commit identity theft. The best way to protect yourself from Medicare fraud is to always be extra careful with giving out personal information over the phone or online.

Fraudsters often attempt to gain access to sensitive information like Medicare numbers and other personal details. To stay safe, never give out your Medicare information unless you are absolutely certain that the person you are speaking with is legitimate.

What to Do to Avoid Medicare Fraud?

If someone calls you claiming to be from Medicare, hang up and call the Medicare customer service line to verify if the person is who they claim to be. Similarly, if you receive an email claiming to be from Medicare, don’t open it and contact the Medicare customer service line to confirm its legitimacy.

Be on the lookout for charges that you do not recognize or do not remember making, as this could indicate fraudulent activity. Also be aware of any discrepancies in the amounts charged, as this could also be a sign of fraudulent activity.

If you suspect any fraudulent activity, it is important to contact your local Medicare office immediately. It is also wise to review your Medicare statement regularly to ensure that all of the information is accurate and up-to-date.

Fake Lotteries

Fake lotteries have become one of the prevalent scams targeting seniors for many years. This scam is particularly dangerous as it preys on the fact that older individuals may not be as tech-savvy as younger generations and therefore more vulnerable to falling prey to their schemes.

Scammers employ diverse tactics to exploit victims, including sending deceptive emails or postcards resembling legitimate lottery notifications, falsely declaring recipients as winners of substantial cash prizes. Additionally, they may impersonate lottery officials when contacting victims by phone, coercing them to disclose personal information or send funds to collect their supposed winnings.

Typically, the scammer will ask for personal information and/or payment to cover taxes and/or fees associated with the winnings. It is important to stay vigilant when it comes to scams targeting seniors, especially those claiming to be lotteries or sweepstakes. Unfortunately, the chances of actually winning any legitimate lottery or sweepstakes are incredibly slim.

In addition, you should be aware that any legitimate lottery or sweepstakes will never require any form of payment, such as fees or taxes, in order to claim winnings. Scammers are highly creative when it comes to coming up with new methods of stealing from unsuspecting victims.

This is why it is important to stay vigilant and always be suspicious of any lottery or sweepstakes that ask for payment in order for you to receive the winnings. It is best to do your due diligence and research before entering or responding to any lottery or sweepstakes. This can include verifying the source of the lottery or sweepstakes, reading the official rules and regulations, and understanding the true cost of entry.

Additionally, if you are contacted by someone claiming to be a representative of the lottery or sweepstakes, be sure to confirm their identity and contact the lottery or sweepstakes directly to verify the information provided.

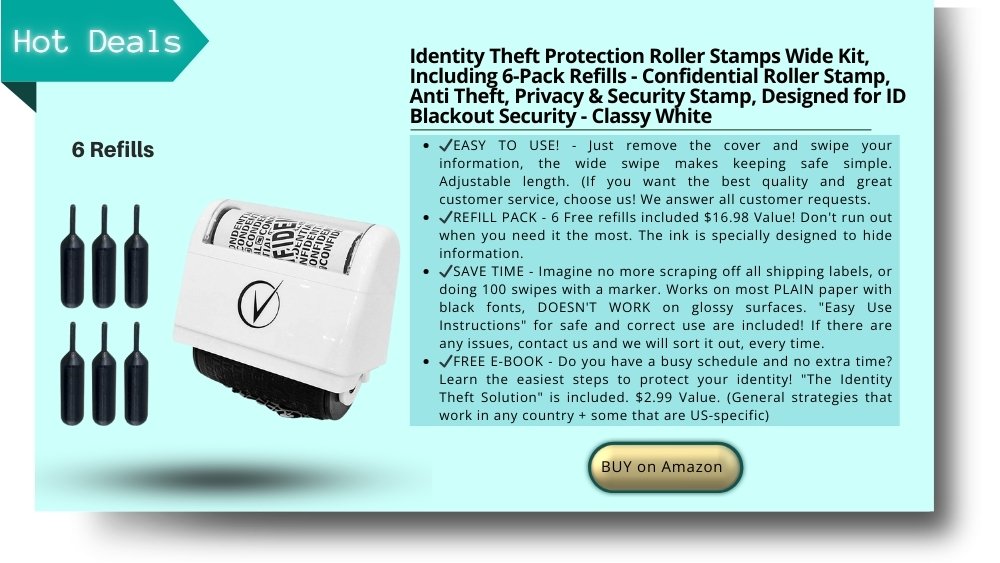

Identity Theft

Identity theft has become one of the most popular scams targeting seniors in 2024 due to the advancements in technology and the prevalence of digital channels. Identity theft is a crime where a person uses another individual’s personal information such as Social Security numbers, credit card numbers, or bank account information, without their permission, in order to make purchases, open new accounts, commit fraud, or even commit a variety of crimes.

It is especially common among seniors because they are more likely to be targeted by scammers and may be less tech-savvy than younger generations. Additionally, due to their age, seniors may not be as aware of the potential risks associated with online transactions, making them more vulnerable to the dangers of identity theft.

Social media accounts identity theft is a serious and dangerous problem, particularly for seniors who may not be aware of the risks associated with online identity theft. The risk of identity theft increases as seniors become more active online and share personal information with friends and family.

In addition to the financial repercussions of identity theft, seniors should also be aware of the emotional toll it can take on them. While the financial losses can be devastating, it can also be embarrassing and emotionally damaging for an elderly person to have their identity stolen.

It is essential that seniors become educated on the risks associated with online activities and take measures to ensure their personal information is secure. This includes using strong passwords for accounts, avoiding suspicious emails and websites, and never sharing sensitive personal information, such as Social Security numbers.

As the elderly population increases and more seniors become tech-savvy, they are unfortunately becoming more likely targets of online scams. Cybercriminals often take advantage of the elderly by preying on their inexperience with technology and lack of knowledge of the latest scams. It has become increasingly important for seniors to stay informed on these scams targeting seniors, so they can avoid falling victim to them.

Romance Scams

Romance scams targeting seniors are becoming increasingly common, as they may be more trusting and more likely to believe someone who is claiming to be interested in them romantically. Unfortunately, seniors are frequently targeted by scammers due to the fact that they are more likely to be vulnerable.

Romance scams targeting seniors are a type of fraud that typically involve a scammer posing as a romantic partner to gain trust and access to their victim’s finances. In many cases, the scammer will pretend to be someone who is looking for a committed relationship and will take advantage of their victim’s loneliness and vulnerability. They may also use social media platforms or online dating sites to target their victims.

Seniors may be more susceptible to believing the false pretences of someone who is trying to manipulate them for financial gain. Furthermore, they may be less likely to report such scams targeting seniors, due to feelings of embarrassment or shame. It is important to be aware of the signs of romance scams targeting seniors and to take steps to protect oneself against them.

These include being aware of any red flags in a potentially suspicious situation, such as someone asking for money or personal information. Since seniors may have less experience recognizing red flags in relationships, it is making them even more susceptible to falling victim to a scam.

Finally, scammers may find that seniors are more likely to have access to retirement funds, which could make them a more attractive target. Seniors may be more likely to have saved up a larger amount of money in a retirement fund due to their age, and they may be more trusting and vulnerable to deceptive tactics.

Online Shopping Scams: Bogus Offers

Online shopping scams targeting seniors are bogus offers that can have serious financial repercussions if taken advantage of. These scams targeting seniors often involve fraudulent sellers who make offers that seem too good to be true. Unsuspecting seniors may be tempted to take advantage of the “great deal” or “once-in-a-lifetime opportunity,” but it is important to remember that if it seems too good to be true, it most likely is not legitimate.

Scammers are becoming increasingly sophisticated and can be difficult to spot. They may offer discounts on items that don’t actually exist or ask for payment in advance for items that will never be shipped. Additionally, they may use deceptive marketing tactics such as fake emails, pop-up ads, or even fake websites to lure unsuspecting customers.

Make sure to read reviews and compare prices to ensure that you are getting the best deal. Seniors should be especially cautious when shopping online, as scam artists often target this age group in particular. It’s important to research any offers before providing payment and to always use a secure payment method if purchasing something online.

It’s also helpful to review the website’s privacy policy, as well as the company’s contact information.

It is highly recommended to use caution when viewing emails or ads that sound too good to be true, as they may be associated with a fraudulent scam. Taking the proper steps to protect yourself can help reduce the chances of falling victim to scams targeting seniors.

How to Fight Back: 6 Expert Tips

Empowering seniors to defend themselves against fraud begins with practical, expert-recommended strategies. In this section, we outline six actionable tips that have proven effective in combating scams targeting older adults. Each tip is designed to reinforce vigilance, reduce risk, and promote informed decision-making.

- Verify Unexpected Calls and Communications:

- One of the most effective ways to protect yourself is to verify the authenticity of any unexpected communication. If you receive a call or message claiming to be from a government agency, financial institution, or even a relative in distress, do not act immediately.

- Instead, hang up or set aside the message, and then contact the organization directly using a phone number or email address obtained from their official website.

- This small step can prevent a moment of panic from leading to irreversible actions, such as wiring money or sharing personal information. It is also advisable to question any urgency in the request, as genuine representatives typically provide you with time to verify details.

- Enable Two-Factor Authentication (2FA):

- Strengthening your online security is critical. Enabling two-factor authentication on bank accounts, email accounts, and other critical services adds an extra layer of protection. Even if scammers manage to obtain your password, 2FA can prevent unauthorized access by requiring an additional verification step. This extra safeguard is a simple yet powerful tool in protecting sensitive information and reducing the risk of identity theft.

- Educate Family and Friends:

- Fraud prevention is a community effort. Share scam alerts and best practices with family members and friends, especially those who may also be at risk. Resources like the FTC’s Consumer Sentinel Network offer up-to-date information on current scams and can help everyone in your circle stay informed. By educating your support network, you create a system of checks and balances that can catch potential fraud before it escalates.

- Never Share Personal Information Over the Phone or Online:

- Your Medicare number, Social Security number, passwords, or any other sensitive information should remain private. Legitimate organizations will rarely, if ever, ask for such details unsolicited. Be particularly cautious with unsolicited calls or emails, and always verify the legitimacy of the request before sharing any information. This rule is especially important in situations where the caller creates a sense of urgency.

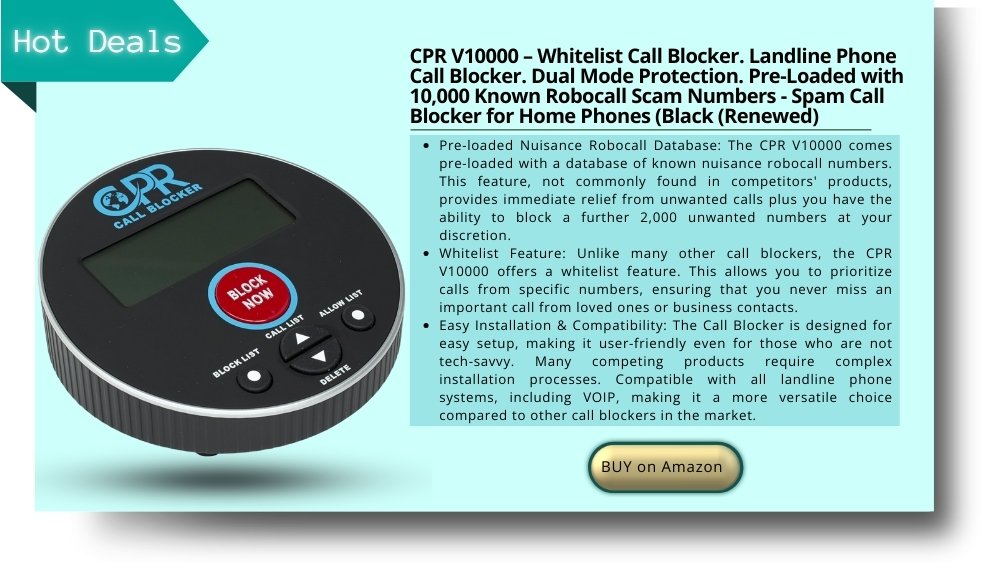

- Use Call Blockers and Spam Filters:

- Technological solutions such as call blockers (for example, Nomorobo) and spam filters provided by phone carriers can help reduce the number of unwanted calls. These tools are designed to identify and block known scam numbers and suspicious communications, thereby reducing the chances of falling victim to a scam. Regularly update these tools to ensure they are effective against the latest tactics used by fraudsters.

- Report Suspicious Activity Promptly:

- If you encounter a suspicious call, email, or other communication, do not hesitate to report it. Filing a complaint with the FTC at ReportFraud.ftc.gov and notifying local law enforcement can help authorities track and dismantle fraudulent operations. Prompt reporting not only aids in your own protection but also contributes to a broader effort to safeguard the senior community from scammers.

Implementing these six expert tips can significantly reduce the risk of falling victim to scams. By staying vigilant, leveraging technology, and maintaining open lines of communication with trusted individuals, seniors can create a robust defense against fraud. The combination of practical measures and proactive education is key to ensuring long-term security and peace of mind in a landscape where scammers continue to evolve their tactics.

Free Resources for Seniors

Access to trusted resources is essential for seniors to stay informed and protect themselves from emerging scams. Fortunately, several organizations offer free services, helplines, and educational materials specifically designed to empower older adults in the fight against fraud.

One of the most notable resources is the AARP Fraud Watch Network. This organization provides a dedicated helpline (1-877-908-3360) where seniors can obtain guidance, report suspicious activities, and receive up-to-date alerts on current scams. The AARP Fraud Watch Network also offers educational materials and community outreach programs that help seniors understand the latest threats and learn practical ways to avoid becoming victims.

For those seeking to deepen their understanding of online safety, the recommended read “Scam Me If You Can: Simple Strategies to Outsmart Today’s Rip-off Artists” by Frank Abagnale offers insights into the practical steps seniors can take to protect themselves online. Written in accessible language, this guide covers topics such as identifying phishing emails, setting up secure online accounts, and understanding the basics of digital privacy. Its emphasis on actionable advice makes it an essential tool for anyone looking to bolster their cybersecurity practices.

Local community centers, libraries, and senior centers offer free workshops on digital literacy and fraud prevention. Topics include call blockers, social media privacy, and common scams. Participating in these programs helps seniors learn new skills and connect with peers. The FTC’s Consumer Sentinel Network provides free databases of reported scams for staying informed and verifying suspicious offers.

By taking advantage of these free resources, seniors can arm themselves with knowledge and support, significantly reducing the likelihood of falling victim to scams. The information provided by these organizations is continually updated, ensuring that seniors have access to the latest advice and strategies in a rapidly changing digital environment. In essence, these free resources form a robust support network that can empower seniors to confidently navigate both online and offline spaces while safeguarding their personal and financial well-being.

Conclusion

It is important for seniors to be aware of the most common scams targeting their age group. It is important to stay informed and to be on alert for any suspicious activity. By understanding the various scams targeting seniors, they can protect themselves from becoming victims and can help others in their community to do the same.

If you have elderly family members or friends, be sure to share this information with them. You might also like to read how to select the Best Health Insurance Coverage.