The Best Country to Retire to… Lies, damned lies, and statistics!

Last Updated on August 26, 2025 by David

The saying may be attributed to Mark Twain but the truth is univeral. Numbers and reality are not always aligned. A case in point is the true living standards of citizens of first world countries.

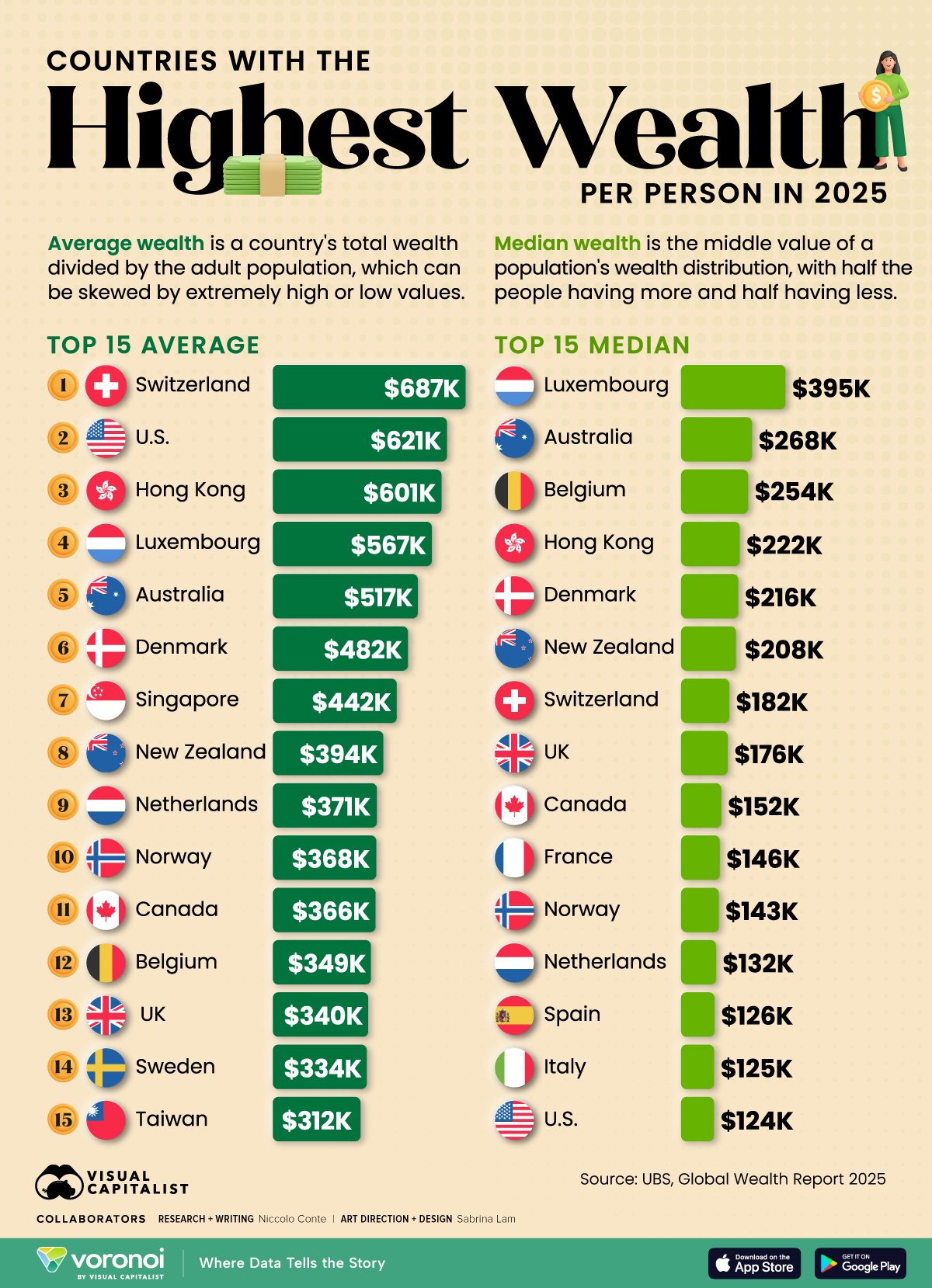

When retirees begin researching international retirement destinations, they’re often drawn to countries with impressive “average wealth” statistics. The United States, for instance, boasts the second-highest average wealth per person globally at $621,000, trailing only Switzerland at $687,000. But here’s the uncomfortable truth: these eye-catching figures mask a reality that could derail your retirement dreams faster than a market crash.

The Great Statistical Deception: Why Average Wealth Misleads

Average wealth figures are essentially meaningless for retirement planning because they’re heavily skewed by extreme inequality. As the chart below shows, average weath in the United States is $621,000 per adult citizen. Impressive! But recent Federal Reserve data shows the top 1% of Americans held 30.8% of total U.S. net worth as of 2024!

The data further shows that, as of the first quarter of 2024, the top 10% of Americans owned almost two-thirds of total U.S. wealth. That leaves the vast majority of American adults – 89% – sharing the remaining one-third!

Quite simply, averages create a statistical illusion. When billionaire Elon Musk’s $244 billion fortune (October 2024) gets averaged with everyone else’s, it artificially inflates the mean. The result? A country that appears wealthy on paper but leaves many retirees financially vulnerable in reality.

Switzerland faces similar challenges. With a Gini coefficient of 0.33 (where 0 represents perfect equality and higher numbers indicate greater inequality), Switzerland shows moderate but still significant wealth concentration. While the country tops average wealth rankings, this masks significant disparities that make it unsuitable for middle-class retirees.

The Median Truth: A Better Measure for Real People

Median wealth tells a fundamentally different story. This metric represents what the typical citizen actually has – half the population owns more, half owns less. The differences are stark:

Top 10 Countries by Median Wealth (2025):

- Luxembourg – $395,000

- Australia – $268,000

- Belgium – $254,000

- Hong Kong – $222,000

- Denmark – $216,000

- New Zealand – $208,000

- Switzerland – $182,000

- United Kingdom – $176,000

- Canada – $152,000

- France – $146,000

Notice how the United States, second in average wealth, plummets to 15th place in median wealth at just $124,000 (see chart). This represents the actual financial reality for typical American retirees.

Australia: The Hidden Retirement Gem

For most retirees with comfortable but not excessive savings, Australia emerges as a compelling choice. Here’s why:

Healthcare: The Foundation of Retirement Security

In the U.S., a 65-year-old retiring today can expect to spend $165,000 on healthcare throughout retirement, with additional projections suggesting costs could reach $320,000 for women due to longer life expectancy. Meanwhile, Medicare Part B premiums alone will cost $185 per month in 2025, with higher earners paying up to $628.90 monthly.

Australia’s universal healthcare system provides a stark contrast. Australian retirees receive comprehensive medical coverage through Medicare, with additional concessions available through the Pensioner Concession Card and Commonwealth Seniors Health Card. The system covers bulk-billed GP visits, hospital care, and subsidized medications – removing the primary financial stress that bankrupts American retirees.

The Age Pension Safety Net

Around 2.6 million Australians receive the Government Age Pension, with approximately 39% receiving the full pension and 24% receiving a partial pension. As of September 2025, maximum rates are $1,178.70 per fortnight for singles ($30,646 annually) and $1,777.00 per fortnight combined for couples ($46,202 annually), creating a substantial foundation for retirement income that places recipients well above poverty levels.

Importantly, the family home isn’t counted as an asset for pension testing, meaning retirees can maintain their lifestyle while still qualifying for benefits. This represents a significant advantage over many other systems.

The Superannuation Advantage

Australia’s $3.7 trillion superannuation system is considered “the envy of the wealthy world” by financial leaders including BlackRock’s Larry Fink. For those 60 and older, superannuation payments are typically tax-free, providing significant advantages over traditional retirement accounts.

Country-by-Country Analysis: Top 10 by Median Wealth

Let’s examine each of the top-ranking countries by median wealth:

1. Luxembourg ($395K median wealth)

Pros: Luxembourg topped the Health Retirement sub-index in 2024 due to high life expectancy scores. Excellent infrastructure and central European location.

Cons: Extremely high cost of living. Limited healthcare options for English speakers. Complex residency requirements.

Verdict: Suitable only for very wealthy retirees.

2. Australia ($268K median wealth)

Pros: English-speaking, excellent healthcare, stable government, reasonable cost of living outside major cities, strong pension system.

Cons: Distance from family in Northern Hemisphere, high property prices in major cities.

Verdict: Ideal for most middle-class retirees.

3. Belgium ($254K median wealth)

Pros: Central European location, good healthcare, moderate costs. Cons: Complex tax system, language barriers, variable weather. Verdict: Good for EU citizens, challenging for others.

4. Hong Kong ($222K median wealth)

Pros: No capital gains tax, excellent healthcare, cosmopolitan lifestyle.

Cons: Extremely high property costs, political uncertainty, air quality issues.

Verdict: Declining attractiveness due to recent changes.

5. Denmark ($216K median wealth)

Pros: Ranks in the top 10 globally for retirement security, excellent social services.

Cons: Very high taxes, expensive living costs, harsh winters.

Verdict: Great for those who can afford the tax burden.

6. New Zealand ($208K median wealth)

Pros: English-speaking, beautiful environment, stable politics, reasonable healthcare.

Cons: Limited direct flights globally, high cost of imports, earthquake risk.

Verdict: Excellent for those seeking peace and natural beauty.

7. Switzerland ($182K median wealth)

Pros: Switzerland overtook Norway for first place in retirement security rankings with an 82% score, political stability, excellent infrastructure.

Cons: Extremely high living costs, complex bureaucracy, language requirements.

Verdict: Only for the very wealthy despite the median wealth figure.

8. United Kingdom ($176K median wealth)

Pros: English-speaking, excellent cultural amenities, good transport links. Cons: High taxes, variable healthcare quality, expensive housing, Brexit complications. Verdict: Familiar but expensive choice for American retirees.

9. Canada ($152K median wealth)

Pros: English-speaking (mostly), excellent healthcare, cultural similarity to US.

Cons: Harsh winters, high taxes, expensive major cities.

Verdict: Good for those wanting familiarity with better healthcare.

10. France ($146K median wealth)

Pros: Excellent lifestyle, good healthcare, rich culture, moderate climate in south.

Cons: Complex bureaucracy, language barriers, high taxes for residents.

Verdict: Attractive for those willing to navigate the system.

The American Retirement Reality Check

Despite the United States ranking second globally in average wealth, it presents significant challenges for typical retirees:

Healthcare Bankruptcy: Healthcare costs averaging $165,000 over retirement can devastate savings, especially with Medicare deductibles of $1,676 for hospital stays and constantly rising premiums.

Wealth Inequality: The top 1% of U.S. earners make about 40 times more than the bottom 90%, while roughly 33 million American workers earn less than $10 per hour.

Government Debt Concerns: Public debt in OECD countries has more than doubled in the first quarter of the 21st century, raising questions about future Social Security sustainability. While this is a concern (and planning consideration) for most first world countries, public debt in the USA is exceptionally high and is accelerating.

The Retirement Security Rankings Tell the Real Story

Multiple independent studies confirm that average wealth doesn’t translate to retirement security:

The 2024 Natixis Global Retirement Index places Switzerland first, followed by Norway, Iceland, and Ireland, with Luxembourg, Netherlands and Australia all finishing in the top seven. The United States has slipped significantly, falling from 16th in 2020 to 22nd in 2024!

The Mercer CFA Institute Global Pension Index gives A-grades only to the Netherlands, Iceland, Denmark, and Israel, again excluding the United States from top-tier retirement destinations.

The Bottom Line

For retirees with comfortable but not exceptional savings, Australia offers the optimal combination of:

- Median wealth that reflects real affordability ($268,000)

- Universal healthcare removing the biggest retirement risk

- English-speaking environment with familiar legal systems

- Stable democratic government with strong institutions

- Comprehensive pension system providing a safety net

- Top-seven global ranking for retirement security

While the United States may dazzle with average wealth statistics, its extreme inequality, healthcare costs, and systemic risks make it suitable primarily only for the genuinely wealthy. For everyone else, countries like Australia, with their focus on median prosperity and comprehensive social safety nets, offer far more realistic paths to a secure and comfortable retirement.

The lesson is clear: when planning your retirement destination, ignore the statistical sizzle of average wealth and focus on the substance of median prosperity and comprehensive support systems.

Your future self will thank you for looking beyond the numbers to the reality beneath.