Last Updated on June 27, 2025 by Julian Espinosa

Ready to transform your retirement income? If you’re wondering how to make your savings work harder for you, you’ve come to the right place.

This comprehensive guide reveals proven strategies that can boost your retirement income within the next 12 months, from leveraging dividend-paying stocks and rental properties to exploring creative income streams like virtual event planning and craft businesses.

Whether you’re already retired or planning for the future, these actionable strategies address the evolving landscape of retirement planning. Recent updates to the classic 4% rule now suggest retirees can safely withdraw 4.7% of their portfolio in the first year of retirement, giving you more flexibility than ever before.

We’ll explore everything from traditional investment approaches to innovative income sources, helping you create multiple revenue streams that provide both stability and growth potential.

You’ll discover how to maximize dividend income, turn your skills into profitable ventures, and leverage technology to create passive income streams. These aren’t get-rich-quick schemes — they’re time-tested strategies adapted for today’s economic environment, designed to help you enjoy the retirement you’ve earned while maintaining financial security for years to come.

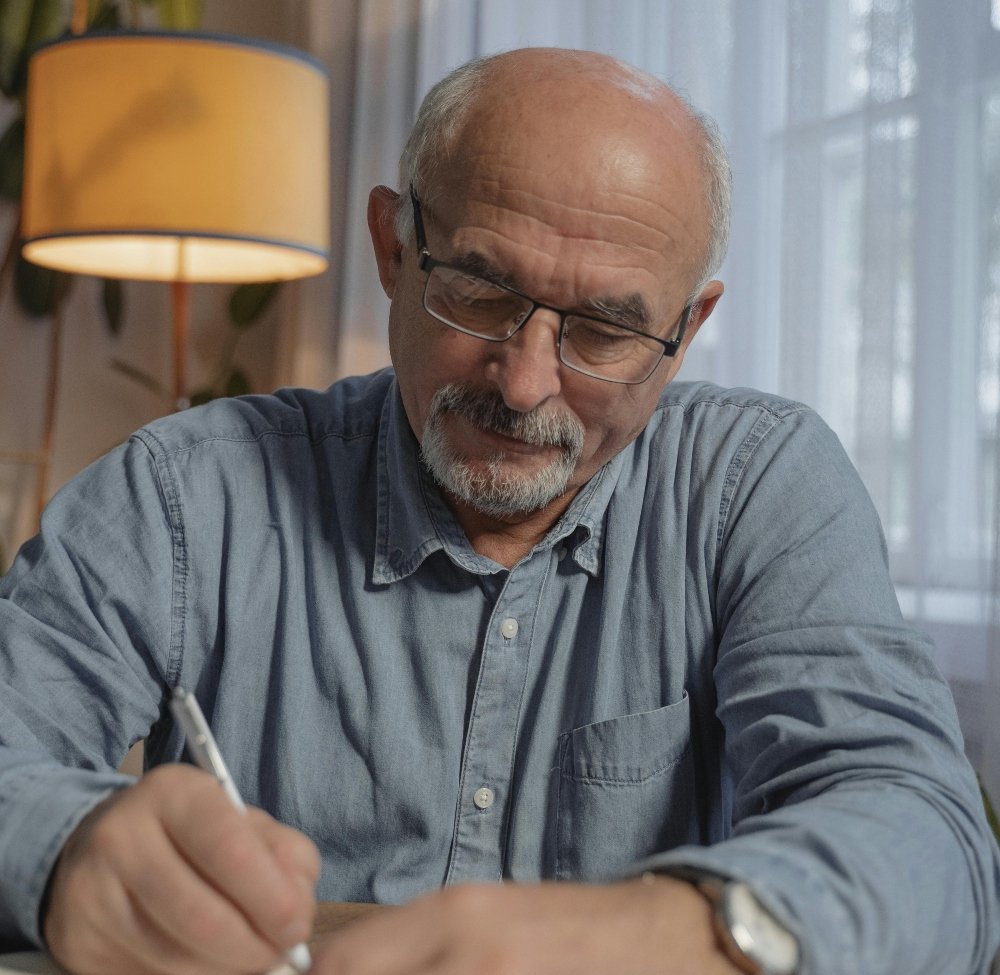

Retirement should be a period of enjoyment and relaxation, not financial anxiety. Many retirees find themselves looking for ways to supplement their income, and the good news is that there are numerous effective strategies to increase your retirement income within 12 months.

These approaches range from optimizing your investment portfolio to exploring creative income-generating opportunities that align with your interests and skills.

Methods to Maximize Your Retirement Income

The landscape of retirement income has evolved significantly. Current retirement income strategies focus on two main approaches: an income-centric approach that prioritizes dividend-paying investments, and a total return approach that focuses on portfolio growth with periodic harvesting. Many financial experts now recommend a hybrid approach that combines both strategies for optimal results.

Creating a diversified portfolio that balances risk and return helps ensure a stable income stream throughout retirement, with regular portfolio rebalancing being essential to align with changing income needs and market conditions. The key is understanding which approach works best for your specific situation and risk tolerance.

Prefer to listen rather than read?

Maximizing Investment Income Through Dividend Strategies

Dividend stocks offer long-term investors unique benefits, with dividends from large, profitable companies providing some of the most reliable income in the stock market. Historically, dividend stocks have outperformed their non-dividend peers, delivering 9.2% annualized returns versus 4.3% from 1973 to 2023, and with lower volatility.

For retirees seeking steady income, companies like AbbVie, ExxonMobil, and Kimberly-Clark provide attractive dividend yields above 3%, with decades-long track records of increasing their payouts. These “Dividend Kings” and “Dividend Aristocrats” offer the stability that retirement portfolios need.

Building a Dividend-Focused Portfolio

A portfolio based around dividend-paying stocks can provide truly passive income, allowing you to rely on payouts rather than selling investments during market downturns. Companies that offer dividends tend to have more stability and better odds of weathering economic downturns than companies that don’t.

Consider using dividend-focused ETFs for instant diversification. ETFs like the Schwab U.S. Dividend Equity ETF (SCHD) with a 3.9% yield, or the Vanguard High Dividend Yield ETF (VYM) provide access to curated selections of dividend-paying companies while reducing individual stock risk.

Updated Withdrawal Strategies

The creator of the 4% rule, Bill Bengen, has now updated his recommendation to suggest that retirees can safely withdraw 4.7% of their portfolio in the first year of retirement. However, Morningstar’s latest research suggests a more conservative 3.7% safe withdrawal rate for 2025, based on forward-looking return forecasts rather than historical data.

For shorter retirement periods, withdrawal rates can be higher—those planning for 20-year withdrawals might safely use initial rates between 5.4% and 6.0%. The key is matching your withdrawal strategy to your specific time horizon and risk tolerance.

Flexible Withdrawal Strategies

Greater flexibility in spending can allow you to start with higher withdrawal rates. Strategies like skipping inflation adjustments during poor market years or using guardrails to adjust withdrawals based on performance can potentially allow starting rates as high as 5.1%.

Dynamic spending strategies can increase safe withdrawal rates significantly—for example, incorporating a -1.5% floor and 5% ceiling approach can increase safe withdrawal rates from 4.3% to 5.0% while maintaining the same level of confidence.

Real Estate as a Retirement Income Source

Real estate remains one of the most reliable ways to generate passive income in retirement. If you have equity in your home or savings to invest, consider these approaches:

- Vacation Rental Properties

- Platforms like Airbnb and VRBO have made short-term rentals more accessible than ever. With proper management (or property management services), vacation rentals can generate significantly higher returns than traditional long-term rentals.

- House Hacking

- If you have space, consider renting out a portion of your home. Converting a basement into a separate unit or renting out spare bedrooms can provide substantial monthly income while allowing you to remain in your familiar environment.

Real Estate Investment Trusts (REITs)

For those who want real estate exposure without direct property management, REITs offer an excellent alternative. These investment vehicles provide regular dividend payments and the potential for capital appreciation while maintaining liquidity that direct real estate ownership lacks.

Creating Income Through Virtual Services

Virtual Event Planning. The digital transformation has created unprecedented opportunities for retirees with organizational skills. Virtual event planning has become a thriving industry, offering flexibility and significant income potential. You can help businesses and individuals coordinate online conferences, webinars, virtual weddings, and digital celebrations.

- Getting Started

- Begin by leveraging your existing network and marketing your services through social media platforms. Many retirees find success starting with small events and gradually building their reputation and client base.

- Business Model

- Define your niche within the virtual event space—whether focusing on corporate conferences, educational workshops, or personal celebrations. Determine pricing structures and consider offering package deals that include pre-event planning, technical support during events, and post-event follow-up.

Freelance Consulting

Your decades of professional experience represent valuable intellectual capital. Many retirees successfully transition their expertise into consulting opportunities, offering services like:

- Business mentoring and strategy development

- Industry-specific consulting based on your career background

- Writing and editing services

- Financial planning and tax preparation assistance

Leveraging Your Creative Skills

Starting a Craft Business. If you enjoy creating with your hands, turning your hobbies into income streams can be both fulfilling and profitable. Consider these approaches:

- Value of Custom Crafts

- Unique, handmade items command premium prices in today’s market. Focus on quality materials and craftsmanship to justify higher price points.

- Where to Market Your Crafts

- Online marketplaces like Etsy provide global reach, while local craft fairs and farmers’ markets offer face-to-face customer interaction. Social media platforms, particularly Instagram and Facebook, can showcase your work and build a following.

- Building a Sustainable Business

- Start small to test market demand, then scale based on what sells well. Consider offering custom work or personalized items, which typically command higher prices and create customer loyalty.

Writing and Publishing Opportunities

Self-Publishing Books. The digital revolution has democratized publishing, making it easier than ever to share your knowledge and experiences through books. Whether you write fiction, memoirs, how-to guides, or specialized non-fiction, self-publishing platforms offer direct access to readers worldwide.

Choosing Your Genre: Consider your expertise and passion areas. Many successful retiree authors focus on topics like:

- Career advice and professional development

- Hobby and craft instruction guides

- Historical accounts or memoirs

- Health and wellness topics

- Travel guides based on personal experiences

Marketing Your Work: Building an author platform through social media, blog writing, and networking is crucial for book sales success. Engaging with your target audience before, during, and after publication helps build a loyal readership.

Blogging and Content Creation: Regular content creation can develop into steady income through various monetization methods including advertising revenue, affiliate marketing, sponsored content, and product sales. Choose topics you’re passionate about and can consistently write about over time.

Investment Diversification Strategies

- Dividend Stock Portfolio Management

- Market volatility makes diversification essential, with investments like Treasury Inflation-Protected Securities (TIPS), high-yield savings accounts, and certificates of deposit providing principal protection alongside dividend-paying stocks.

- Focus on companies with strong fundamentals and long dividend-paying histories. High-yield stocks with dividends above 5% can create substantial monthly income—a $120,000 investment in stocks with 5% average yields generates approximately $500 monthly in dividends.

- Modern Investment Vehicles

- New retirement income solutions are emerging, such as IncomeWise target-date strategies that blend traditional index-based funds with options for participants to activate deferred annuity payments and automatic monthly withdrawals.

- Consider low-cost index funds and ETFs for broad market exposure while maintaining lower fees that can significantly impact long-term returns.

Technology-Based Income Streams

Online Course Creation. Share your professional expertise or hobby knowledge through online course platforms. The e-learning market continues to expand, creating opportunities for subject matter experts to generate ongoing passive income.

- Platform Selection

- Choose platforms that align with your teaching style and target audience, whether focusing on professional development, creative skills, or personal enrichment topics.

- Course Development

- Start with shorter courses to test market demand, then expand successful topics into comprehensive learning programs.

Monetizing Your Blog or YouTube Channel

Content creation can evolve into significant income streams through multiple monetization channels:

- Advertising revenue from platform partnerships

- Affiliate marketing commissions

- Sponsored content opportunities

- Digital product sales

- Membership or subscription services

Building Your Audience: Consistency in posting, engagement with your audience, and providing genuine value are key to building a following that can support meaningful income generation.

Participating in Market Research and Focus Groups

Many companies value the perspectives of mature adults for product development and market research. These opportunities provide supplemental income while allowing you to influence products and services you might use.

- Online Survey Platforms

- Websites like Swagbucks, Survey Junkie, and UserTesting offer paid opportunities to share opinions on various products and services.

- In-Person Focus Groups

- Local market research companies often seek participants for focus groups that pay significantly more than online surveys, typically ranging from $75 to $200 per session.

Tax-Efficient Income Strategies

Understanding Tax Implications. Dividends held in taxable accounts often receive favorable tax treatment compared to ordinary income, with qualified dividends taxed at lower capital gains rates rather than ordinary income rates.

Early retirement offers excellent opportunities for proactive tax planning, including managing tax brackets, minimizing Medicare IRMAA surcharges, and executing tax-efficient withdrawal strategies.

Strategic Account Management

Consider which types of income and investments work best in different account types:

- Tax-efficient investments in taxable accounts

- Tax-deferred investments in traditional IRAs and 401(k)s

- Tax-free growth investments in Roth accounts

Building Multiple Income Streams

Diversification Beyond Investments. The most financially secure retirees typically have multiple income sources. Consider combining several of these strategies:

- Investment Income: Dividends, interest, and capital gains from a well-diversified portfolio

- Active Income: Part-time work, consulting, or business ventures

- Passive Income: Rental properties, royalties, or automated online businesses

- Government Benefits: Social Security, pensions, or other entitlements

Managing Cash Flow

Retirement spending often follows a “smile” pattern: higher in early retirement during active years, stabilizing in middle retirement, and potentially rising again later due to healthcare needs. Plan your income strategies to accommodate these changing needs over time.

Risk Management and Safety Considerations

- Protecting Your Principal

- Conservative investments like stable value funds, Treasury securities, and high-quality corporate bonds provide principal protection while offering better returns than standard savings accounts.

- Balance growth-oriented investments with capital preservation to ensure you have reliable income regardless of market conditions.

- Emergency Preparedness

- Maintain adequate emergency reserves separate from your income-generating investments. Ample cash reserves help weather market volatility and provide flexibility during unexpected expenses or income disruptions.

Getting Started: Your 12-Month Action Plan

Months 1-3: Assessment and Planning

- Evaluate your current financial situation and income needs

- Research dividend stocks and create a target investment list

- Identify skills or interests that could become income sources

- Set up necessary accounts and platforms for your chosen strategies

Months 4-6: Implementation

- Begin investing in selected dividend stocks or funds

- Launch your first income-generating project (blog, craft business, consulting service)

- Apply for relevant opportunities (focus groups, market research)

- Start building your online presence if pursuing digital income streams

Months 7-9: Optimization and Expansion

- Evaluate the performance of your initial investments and strategies

- Expand successful income streams

- Consider additional opportunities based on what’s working well

- Adjust your approach based on early results

Months 10-12: Refinement and Growth

- Fine-tune your portfolio allocation

- Scale up successful business ventures

- Plan for year two expansion

- Document lessons learned and successes achieved

Conclusion

Increasing your retirement income within 12 months is absolutely achievable with the right combination of strategies tailored to your interests, skills, and risk tolerance. The key is starting with a solid plan, remaining consistent in your efforts, and being willing to adapt your approach based on what works best for your situation.

Remember that the most successful retirement income strategies often combine multiple approaches. You might find that dividend investing provides your foundation while a small business venture adds meaningful supplemental income and personal fulfillment. The important thing is to begin taking action toward your goals.

Are you ready to take control of your retirement income and create the financial security you deserve? Which of these strategies resonates most with your interests and current situation? We’d love to hear about your experiences and any questions you might have as you begin this journey toward greater financial independence.

FAQ: Methods to Increase Your Retirement Income

- What’s the current safe withdrawal rate for retirement

- The withdrawal rate landscape has evolved, with the original 4% rule creator now suggesting 4.7%, while Morningstar’s latest research recommends a more conservative 3.7%. The appropriate rate depends on your specific situation, time horizon, and risk tolerance. Using flexible withdrawal strategies, such as skipping inflation adjustments during poor market years, can potentially allow starting rates as high as 5.1%.

- Are dividend stocks still a good choice for retirement income?

- Yes, dividend stocks remain excellent for retirement income. Historical data shows dividend stocks have outperformed non-dividend paying stocks, delivering 9.2% annualized returns versus 4.3% from 1973 to 2023, with lower volatility. Companies that pay dividends tend to have more stability and better odds of weathering economic downturns, making them particularly attractive for retirees seeking steady income.

- How much monthly income can I expect from dividend investments?

- A $120,000 investment in stocks with an average dividend yield of 5% creates approximately $500 per month in dividends. However, dividend yields vary significantly by company and market conditions. Quality dividend stocks like AbbVie (3.2% yield), ExxonMobil (3.4% yield), and Kimberly-Clark offer attractive yields with long histories of dividend increases.

- What are the tax implications of dividend income in retirement?

- Dividends held in taxable accounts often receive favorable tax treatment, with qualified dividends taxed at lower capital gains rates rather than ordinary income rates. This can result in substantial tax savings compared to other forms of income. However, dividend income is generally taxed at ordinary income rates unless it qualifies as qualified dividend income, so proper planning is essential.

- Should I invest in individual dividend stocks or dividend ETFs?

- Dividend ETFs offer instant diversification—if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. ETFs like SCHD (3.9% yield) and VYM provide access to curated selections of dividend-paying companies while reducing individual stock risk. For most retirees, dividend ETFs provide better risk management than individual stocks.

- How can I protect my retirement income from inflation?

- Consider Treasury Inflation-Protected Securities (TIPS) and other inflation-hedged investments alongside dividend-paying stocks. Many quality dividend-paying companies have track records of increasing their dividends annually, which can help combat inflation over time. The updated withdrawal strategies adjust annually for inflation, similar to Social Security.

- What’s the biggest risk with dividend-focused retirement strategies?

- Companies can choose not to declare dividends, which can negate the benefit of diversifying a retirement portfolio with dividend-paying stocks. Additionally, sequence of returns risk means that market downturns early in retirement can significantly impact portfolio longevity. Diversification across multiple dividend-paying companies and sectors helps mitigate these risks.

- How do current interest rates affect retirement income strategies?

- Thanks to higher bond and cash yields, it’s getting easier to generate a livable stream of retirement income from a portfolio compared to the low-rate environment of recent years. Current market conditions offer better opportunities for fixed-income investments than we’ve seen in years, providing more options for conservative income generation.

References

- Morningstar. “The Best Ways to Generate Income in Retirement.” March 6, 2025.

- T. Rowe Price. “Retirement savings by age: What to do with your portfolio in 2025.” 2025.

- Bankrate. “5 Best Retirement Income Strategies.” April 2025.

- U.S. News & World Report. “7 High-Return, Low-Risk Investments for Retirees.” March 27, 2025.

- Yahoo Finance. “The 4% rule creator reveals the new safe retirement withdrawal rate.” March 16, 2025.

- Morningstar. “Morningstar’s Retirement Income Research: Reevaluating the 4% Withdrawal Rule.” March 3, 2025.

- 247 Wall St. “The Only 5 ETFs You Need to Build Wealth for Retirement.” May 19, 2025.

- The Motley Fool. “3 High-Yielding Dividend Stocks That Retirees Can Buy and Forget About.” April 3, 2025.

- CNBC. “Use this passive income strategy to ‘set yourself up quite nicely’ in retirement.” March 10, 2025.

- Kiplinger. “Dividend Stocks Can Boost Your Retirement Income Stream.” July 2024.

- Investopedia. “Understanding Dividends for Retirement Income.” 2025.

- Sure Dividend. “10 High-Yield Stocks For Lasting Retirement Income.” December 31, 2024.

Disclaimer

The content provided on MySeniors.World is for informational purposes only and is not intended as either financial or medical advice. Always consult a qualified professional before making any investment or health-related decisions.

Posts may contain affiliate links, meaning we earn a commission – at no additional cost to you, if you click through and make a purchase. Your support helps us continue providing valuable content.